Actor John Currivan gives his advice on preparing for the big drop in income between acting work…

Steady and high paying acting jobs are rare in our business. Having them makes us feel like we’re flying high! We eye the start date of a long-term contract like a pilot eyes up their launch schedule. In our excitement we might ignore the other date on the contract… the end date. It’s understandable. We want to soar above the clouds forever. However, every journey ends eventually and we, the pilots, need to ensure that what could easily be a sudden and devastating crash, is actually a smooth and safe landing.

Take stock and take control while you have the work

Congratulations! You’ve got a well-paid acting job. Commiserations! It will eventually end, but the best time to prepare for unemployment is while you still have a job. Whether the contract termination date is one week, month or year away it never hurts to plan ahead. Make a plan that will help you thrive while you’re earning and survive when you’re not. You know those fanatics who have nuclear bunkers filled with tins of beans in case of a zombie apocalypse…? Be like them. Remember that a large GROSS wage is not the same as NET profit. You might see a nice big number written on a contract or pay slip but remember, that all needs to be broken down into:

- Agent’s Commission (between 12.5-20%)

- Personal Tax (Basic Rate = 20% and very important)

- Work/Living Expenses (Travel, rent, food and bills)

- Cash for fun times! (Y’know for holidays, bouncy castles and cake)

- Pension… maybe (more on this later)

- Savings for life (if you can)

- Savings for inevitable unemployment (which you must)

Then you can take stock of the time you have remaining:

- How many days/weeks left of earning income do I have?

- How long will savings last when I’m out of work?

- How long before I have to find more work?

Take notes, make lists, mark calendars and check accounts regularly. You can only fully prepare when you are fully aware (hey, that rhymes). Your hot air balloon will not fly itself. You are the pilot, stay in control.

Regularly save a decent percentage of your weekly or monthly NET profit. I recommend using separate, designated bank accounts and to set up a regular direct debit, so that it all happens automatically. Also, I’m going to sound like a proper, old granny here, but having a well-paid job is the perfect time to get yourself a pension! Pay into it regularly and it will pay you back in the long run, seeing you through when you need it most. For more information on Equity pensions check here.

One last thing: when your wages are high, your tax bill will be high. If you’re not prepared and up to date on what you owe, the bill will tear through your hot air balloon like a bullet and you’ll find yourself in a basket falling to the earth… And then the zombies will get ya. For more information about how the tax man wants to take all your dough check here.

Manage your fuel: money

Another thing that can happen with a long-term, well-paid contract is that you develop what a friend of mine called ‘West End Madness’. You think you’re set for life. You get complacent. You’re overspending on nights out, drinks, meals, bouncy castles and eh… cake. Like a pilot burning fuel too quickly. Look at your ‘Fun times’ expenses (if you have them) and see where you can cut back costs without sacrificing too much enjoyment.

I had my own case of West End madness; meals out in Soho every weekend, during the week too, a few drinks after every other show, to-go coffees every show day. This didn’t seem overly excessive at the time, but it all added up. I was saving for a wedding at the time. I also thought I had another years’ contract coming up… but I didn’t. And I don’t want to poop anyone’s party, but let me put on my ‘tight-with-money hat’ and let you know that…

The average high street take-away coffee = £2.23 (Small latte)

6 coffees a week= £13.38

24 coffees a month= £53.52

288 coffees a year = £642.24

(You can see my source for this info here!)

£642 is a little more than the average UK weekly wage, could cover rent and bills for a month and is worth roughly 12.5 dinner guests at my wedding (one person would have to leave their arms and legs at home).

I was happy to spend this (and more) carelessly, over the year. When I was told the contract would be ending, I panicked. I had a target amount of savings to achieve, and suddenly 8 months less of predicted income before the wedding. So, I cut back. Packed lunches. Fewer nights out. I bought a mug and a jar of coffee for the dressing room rather than going out at every break.

Now, I’d never want to dictate to anyone about how they spend or enjoy their hard earned money – I enjoy an avocado and sourdough breakfast as much as the next millennial – and I’m not saying we need to live like paupers. But we must always be mindful of our income from performance work, especially since we may not have that sort of work for most of our lives. If you burn your fuel you may fly higher, but be prepared to fall further when it runs out.

Suss out and prepare for landing

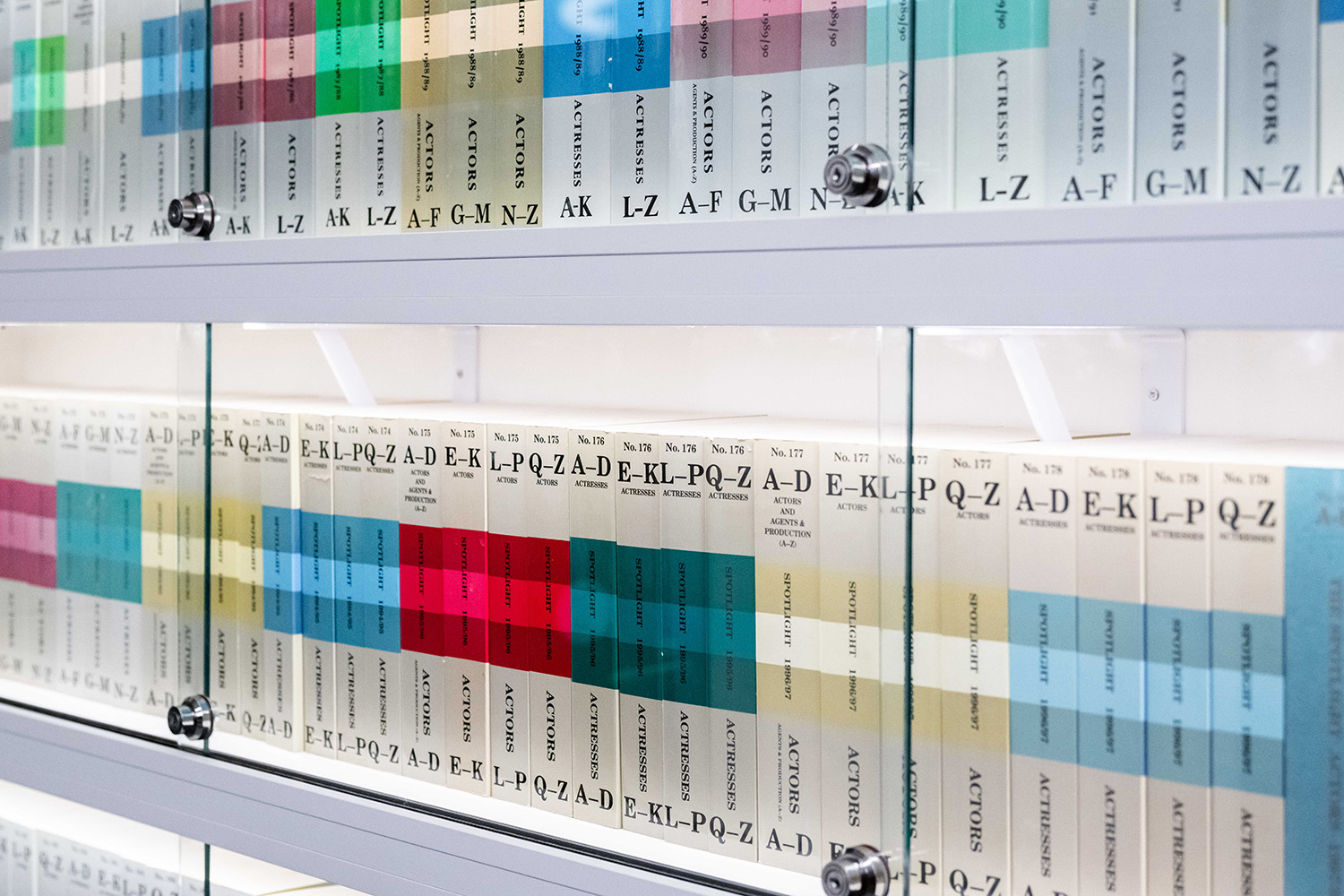

A National Tour, West End gig, or long-term job in a reputable theatre is an amazingly rare thing and looks fantastic on a CV, but is no match for hard work, graft and a genuine connection with the industry. So keep going to see shows on your days off, take part in workshops or masterclasses that improve your skill set. We all know that some of these things can be pricey, so again count the costs of these in with your ‘work expenses’ and claim them in your tax return.

If a contract is ending, make sure that your CV is up to date, and it may be worth pooling a bit more cash into the ‘work expenses’ pile to create or update a showreel or voicereel. These are worthwhile investments that may lead more promising work, but be clever. Get reels that suit your budget, suit you as an artist and that are of a high quality. Get on top of your agent, (figuratively, not literally) and make sure they’re working for you. Get back and stay in touch with any producers and creatives who are active and working. Look at theatres’ upcoming seasons and see if there’s anything there for you. Get those casting directors, producers or directors in to see the show you’re currently in, ASAP! Use the prestige of your work to get people in who otherwise might not see you performing.

Find something else to keep you going

Even though you may have enough savings to see you through a little bit of unemployment, don’t forget to dust off your ‘Normal CV’. A side gig could be just the thing to make sure that your savings stay safe and maybe even grow.

It might be good to go job hunting a few weeks before the contract ends. Or if you’re someone who has a passion project set aside, invest some of your income into creating a viable business out of it. I’ve worked with actors who were also part time personal trainers, photographers, electricians, drama teachers, event hosts and gigged regularly in pubs and bars. Setting up and funding this work up in good times meant they could continue it after the contract ended. I’ve written a bit about balancing performance work and your side gig here.

Others used their time to learn about other theatre disciplines, like stage management, set, sound or lighting design. Some used their position in the theatre to get jobs working front of house in the same venue. They kept roughly the same hours of work, the same workplace and worked with some of the same people.

Keep up with your emotional wellbeing

We also need to be aware that losing regular work and income can be an emotional tornado. We may feel like our lives suddenly lack purpose or meaning. We may blame ourselves, even though the production and funding decisions were never in our hands. As our balloon descends, we may question our validity as artists and performers and worry that our days soaring through the clouds are over forever… F*CK THAT! A performer and artist is more than one show and one role. The end of one journey is not the end of all journeys. Nothing is guaranteed in our business and we need to hold onto and believe in our own skills and talents in the face of adversity. This year, a woman who cleaned toilets between jobs won an Oscar for Best Actress. The dream is always alive.

Keep working. Keep dreaming. And whether your dream job ends with a smash, a crash or a bump, be grateful for any and all the experiences you’ve had and keep your eyes peeled for any opportunities to get back in your balloon. But while you’re wandering round (maybe still fighting zombies) remember that, there are some actors who’ve been down there looking up at you while you were flying. You are not alone.

John is an Irish actor living in London. He started his career in Clondalkin Youth Theatre and trained in the Samuel Beckett Centre, Trinity College, Dublin. He has worked and toured with productions internationally, and starred in The Commitments, in the Palace theatre and on The UK and Ireland Tour. He has written scripts for radio, stage and also for comic books.